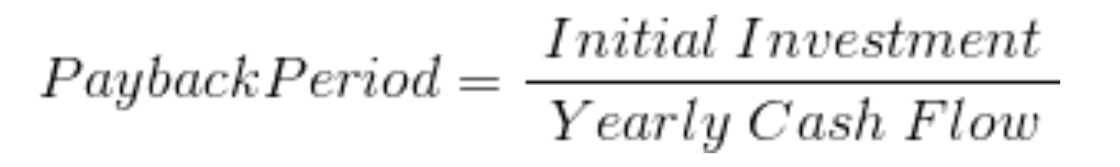

Payback period calculation formula

To calculate the payback period you need. Here is how to calculate the average payment period equation.

Payback Period Formula And Calculator Excel Template

Financial value and project cost.

. Step 2 Calculate the CAC Payback Period. Payback reciprocal is the reverse of the payback period. The current Equity multiplier stands at 9748.

You will discount them using the given cost of capital of 7. Thus it may be concluded that the purchase of such furniture fittings isnt desirable as its payback period of 6 years is more than Caterpillars estimated payback period. The third component of the formula is Equity multiplier.

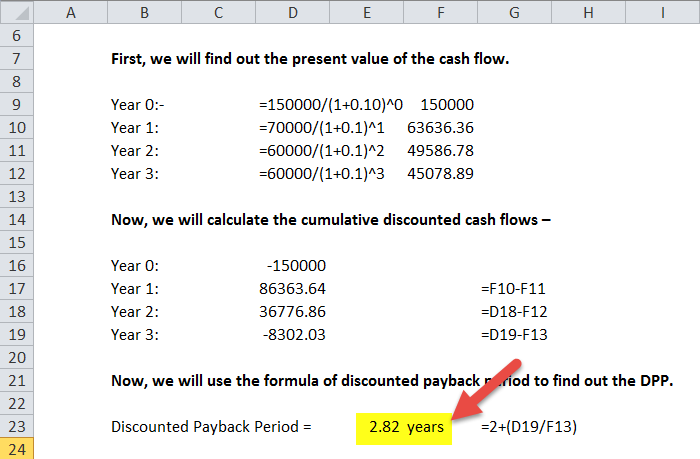

Discounted Payback Period - ln1 -. It does not take into account the social or environmental benefits in the calculation. First well calculate the metric under the non-discounted approach using the two assumptions below.

Using the formula. As shown in the above calculation the Asset turnover stands at 4830. 4mm Our table lists each of the years in the rows and then has three columns.

The payback period does not factor in churn or. The denominator of the calculation is based on the average cash flows from the project over several years - but if the forecasted cash flows are mostly in the part of the forecast furthest in the future the calculation will incorrectly yield a payback period that is too soon. In statistical parlance the term uncertainty is associated with a measurement where it refers to the expected variation of the value which is derived from an average of several readings from the true mean of the data set or readings.

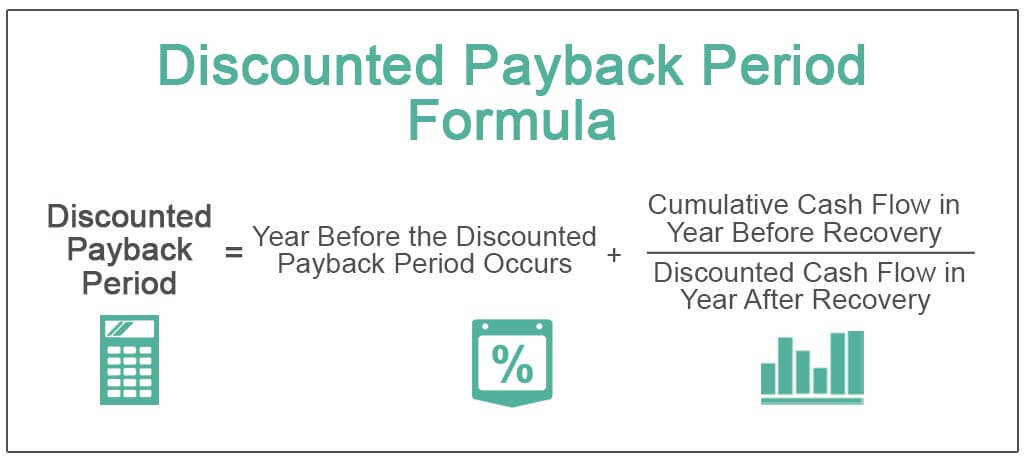

The payback period formula has some unique features which make it a preferred tool for valuation. Discounted Payback Period. A discounted payback period gives the number of years it.

Some of these are This formula is one of the easiest ways for businesses to understand the time itll take for their operations to reach break-even point where there is no profit and no loss. The payback period of a given investment or project is an important determinant of whether. Marginal Cost Change in Costs Change in Quantity Marginal Cost Example Calculation.

Payback Period Example Calculation. Payback period 6 years. The longer the payback period of a project the higher the risk.

The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity. Mileage calculation provided by the Australia Taxation Office - 72 cents per kilometre from 1 July 2020 for the 202021 income year. The formula for discounted payback period is.

Production volume must be tracked across a specified period. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period. Payback Method Example 2.

Uncertainty Formula Table of Contents Formula. 2 Payback Period Helps in Project Evaluation Quickly Example 2. 10mm Cash Flows Per Year.

To calculate NPV using the formula you will calculate the present value of the cash flow from year 1 2 and 3. For more detailed cash flow analysis. As already explained in the example above the calculation of the net debt ratio is pretty simple.

The average payment period is usually calculated using a years worth of information but it may also be useful evaluating on a quarterly basis or over another period of time. CAC MRR and ACS or MRR GM of Recurring Revenue Since I am using MRR the formula will calculate the number of months required to pay back the upfront customer acquisition costs. So the desired period of time may dictate which financial statements are necessary.

The Boeing Company is considering purchasing equipment for 40000. Payback Period 3 1119 3 058 36 years. Calculating value can sometimes be complicated based on the uncertainty of.

Note how year 3 has a cash flow of 540000. The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. The following example illustrates the problem.

Payback Period Formula. Financial value is simply the projects payback. In looking at the formula there are two components we need to determine.

Features of the Payback Period Formula. To a maximum of 5000 business kilometres per car Deductions are only applicable to cars. WACC is the calculation of a firms cost of capital where each category of capital such as equity or bonds is proportionately weighted.

Payback Period Formula Total initial capital investment Expected annual after-tax cash inflow 2000000221000 9 YearsApprox. If you observe the above calculation you will notice that a simple ROE calculation would not have given you a clear picture of the performance of the company. What is Uncertainty Formula.

Next the change in total costs and change in quantity ie. The main issue arises in locating the figures from the financial statementsIt is easy to remember that the short-term debt will always be listed under the current liabilities liabilities or debts due in a year and the long-term debt would be listed under the. The payback period is the length of time required to recover the cost of an investment.

As mentioned above. When deciding whether to invest in a project or when comparing projects having different.

How To Use The Payback Period

Payback Period Method Double Entry Bookkeeping

How To Calculate The Payback Period With Excel

Payback Period Business Tutor2u

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

Payback Period Summary And Forum 12manage

Discounted Payback Period Meaning Formula How To Calculate

Capital Investment Models Payback Period Youtube

How To Find The Payback Period In Excel Mend My Ladder

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator Excel Template

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Undiscounted Payback Period Discounted Payback Period

Undiscounted Payback Period Discounted Payback Period

What Is Payback Period Formula Calculation Example

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube