29+ truth about reverse mortgage

Reverse mortgages are best used as part of an. A 62-year-old with a mortgage-free 300000 home and an expectation of staying in the home 20 years assuming an adjustable-rate mortgage starting at 33 45 percent might get about 570 a month for as long as 20 years but with no initial cash draw.

Premium Photo Selective Focusword Reverse Mortgage With Clockglasses And Dollar Banknote On Red Background

See if you qualify.

. Ad Understand the Downsides of a Reverse Mortgage Loan So You Can Make Informed Decisions. Web Compare adjustable-rate mortgage options and rates including 51 71 and 101 ARMs available from Bank of america. Web Steve Haney The Mortgage Doctor has his own reverse mortgage.

Aug 29 2022 By Audrey Lee. How Does A Reverse Mortgage What Heirs Need to Know About. Ad How Does A Reverse Mortgage Work.

In this article lets separate fact from fiction. Web A prevalent myth about reverse mortgages is they drain home equity leaving little to nothing left for heirs upon the death of the borrower. Ad Looking For Reverse Mortgage Calculator.

Learn More See If You Qualify. Adjustable rate mortgages adjustable rate mortgage arm mortgage arm mortgage loan. Learn More See If You Qualify.

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. As an older American you can turn to reverse mortgages to seek money to pay off your current mortgage finance a major home improvement supplement your retirement income or to pay for those unexpected health care expenses. In addition the loan may need to be paid back sooner such as if you fail to pay property taxes or homeowners insurance or dont keep your home in good repair.

Web What Is a Reverse Mortgage. Hell always tell you the truth. Web A reverse mortgage increases your debt and can use up your equity.

Bill Fraser Sep 20 2018. Essentially a reverse mortgage is a loan based on the equity value of your home. As an older American you can turn to reverse mortgages to seek money to pay off your current mortgage finance a major home improvement supplement your retirement income or to pay for those unexpected health care expenses.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web A reverse mortgage is a tax-exempt home loan that allows a homeowner to take cash-out of their home using their existing home equity without taking on a monthly payment or having to sell their property. Web 29 truth about reverse mortgage Monday February 20 2023 Warning Reverse Mortgage Downsides Disadvantages Reverse Mortgage Stakeholders Dispel Product Myths For Home Care Audience Reverse Mortgage Daily 14 Important Reverse Mortgage Facts Newretirement 27 Sumter County Animal Services.

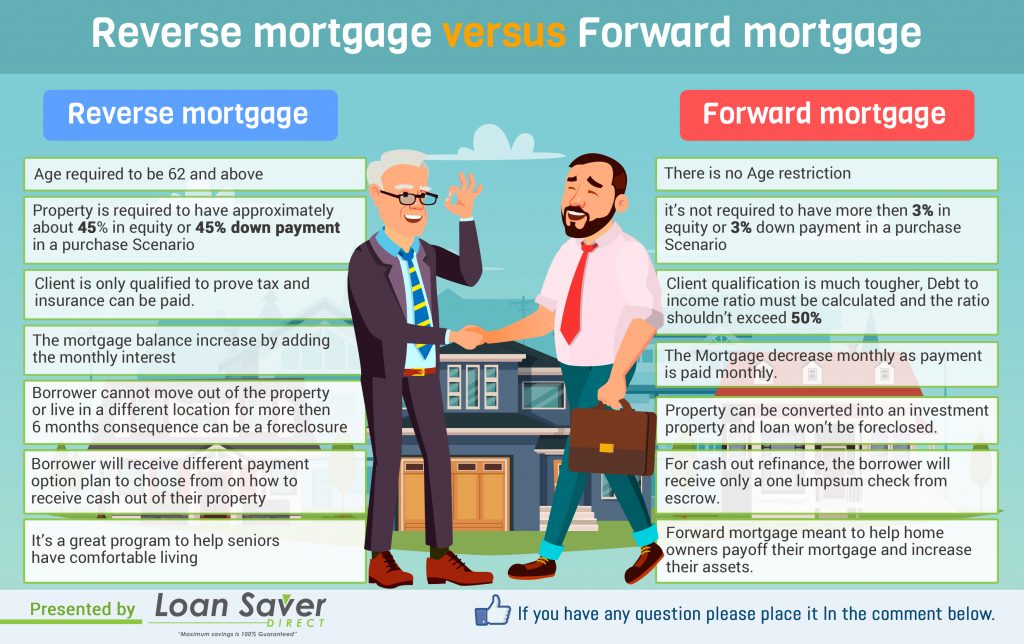

Your debt keeps going up and your equity keeps going down because interest is added to your balance every month. Its no secret that prices are going up and times are tight. Web Should I get a reverse or a forward mortgage loan.

Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and interest. Reverse Mortgages have been available in Canada for 25 years but there are still many myths and misconceptions about them some understandable and some are not accurate.

Or they may consider these loans to supplement their monthly income so they can afford to continue living in their own home longer. Web The Truth About Reverse Mortgages Beware of the pitfalls of reverse mortgages. For retired homeowners this can make staying on budget or meeting unexpected expenses even more difficult especially if they rely on Social Security and pension payments for their main monthly income.

These type loans can allow you to convert part of the equity in. If you are considering a Reverse Mortgage it is. Ad How Does A Reverse Mortgage Work.

Web The earliest age for a reverse mortgage is age 62. Ad How-To Guide for Determining if a Reverse Mortgage Is a Good Fit. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

This option is a. Web The Truth About Reverse Mortgages. Do the Advantages Outweigh the Disadvantages.

Web The Truth About Reverse Mortgages. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. The Truth About Reverse Mortgages CoverageMade One type of reverse mortgage is a single-purpose reverse mortgage.

Ad Dedicated to helping retirees maintain their financial well-being. ReverseVision among 2022 HousingWire TECH100 Mortgage. Learn About Reverse Mortgages With a Free Info Kit From AAG Americas 1 Reverse Lender.

The Truth About Reverse Mortgages and Heir Legacy. Try Our Free Calculator To Receive a General Estimate If You Are Eligible. Web Reverse mortgages are federally insured and one of the most heavily regulated mortgage products on the market today.

Web The Truth About Reverse Mortgages. Financial News UpdatesMortgage Financial StrategiesAuto Finance StrategiesBudgetingSaving Money. If you are 65 or older and have watched your retirement income dwindle a reverse mortgage may seem appealing.

Web The Truth About Reverse Mortgages. Borrowers cannot lose their home so long as they comply with loan responsibilities of paying taxes insuring maintaining the home and occupying it as the primary residence. Web Although reverse mortgages have evolved into an ideal tool for a select group of high-equity homeowners before Congress passed the Reverse Mortgage Stabilization Act in August 2013 reverse mortgages were plagued by many of the same abuses that led to the 2008 mortgage crisis that inspired the mega hit 2015 film The Big.

Weighing the Costs and Benefits by FreeAdvice staff. Web I was once strongly against the idea of Reverse Mortgages I felt that this type of loan structure would steal homes away from familiesUnfortunately I n. March 27 2016 453 pm By Jason Oliva.

Try Our Free Calculator To Receive a General Estimate If You Are Eligible. These types of mortgage loans are only available to homeowners aged 62 or older who occupy a property as their principal residence. Y ouve seen the ubiquitous TV ads the ones with mature celebrities Pat Boone Robert Wagner Henry Fonzie Winkler and Fred Thompson extolling the virtues of a reverse mortgage for.

Web The truth is that most borrowers use their loans for immediate or pressing financial needs such as paying off their existing mortgage or other debts.

Dave Ramsey On Reverse Mortgage Reasons He S Wrong

Reverse Mortgage Pros Cons Starting With The Negatives

Key West Weekly 22 1124 By Keys Weekly Newspapers Issuu

Why Dave Ramsey Is Wrong About Reverse Mortgages Heritage Reverse Mortgage

Dave Ramsey On Reverse Mortgage Reasons He S Wrong

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics

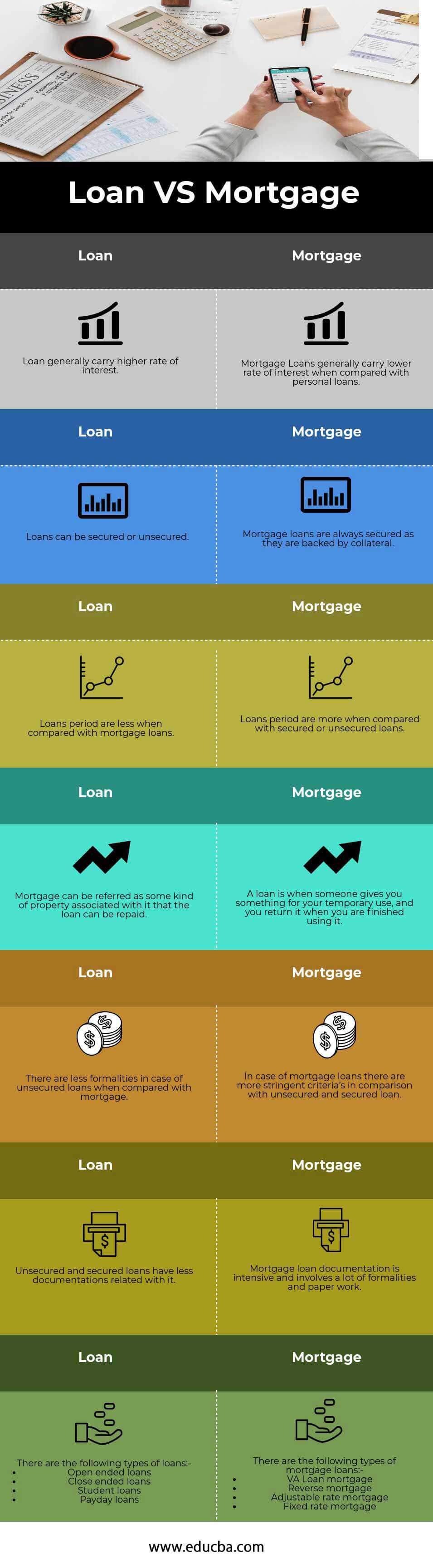

Loan Vs Mortgage Top 7 Best Differences With Infographics

10 Reverse Mortgage Myths Clearing Up Common Misconceptions

Reverse Mortgage Information

Dave Ramsey On Reverse Mortgage Reasons He S Wrong

Know The Reverse Mortgage Myths Vs Facts To Make An Informed Decision

What Is The Downside Of Getting A Reverse Mortgage

Reverse Mortgage Myths Evergreen Home Loans

Dave Ramsey On Reverse Mortgage Reasons He S Wrong

Reverse Mortgage Myths Evergreen Home Loans

Brad Grant Mortgage Broker In Currumbin Waters Mortgage Choice

Why Dave Ramsey Is Wrong About Reverse Mortgages Heritage Reverse Mortgage